Shared by JohnH

From Wikipedia

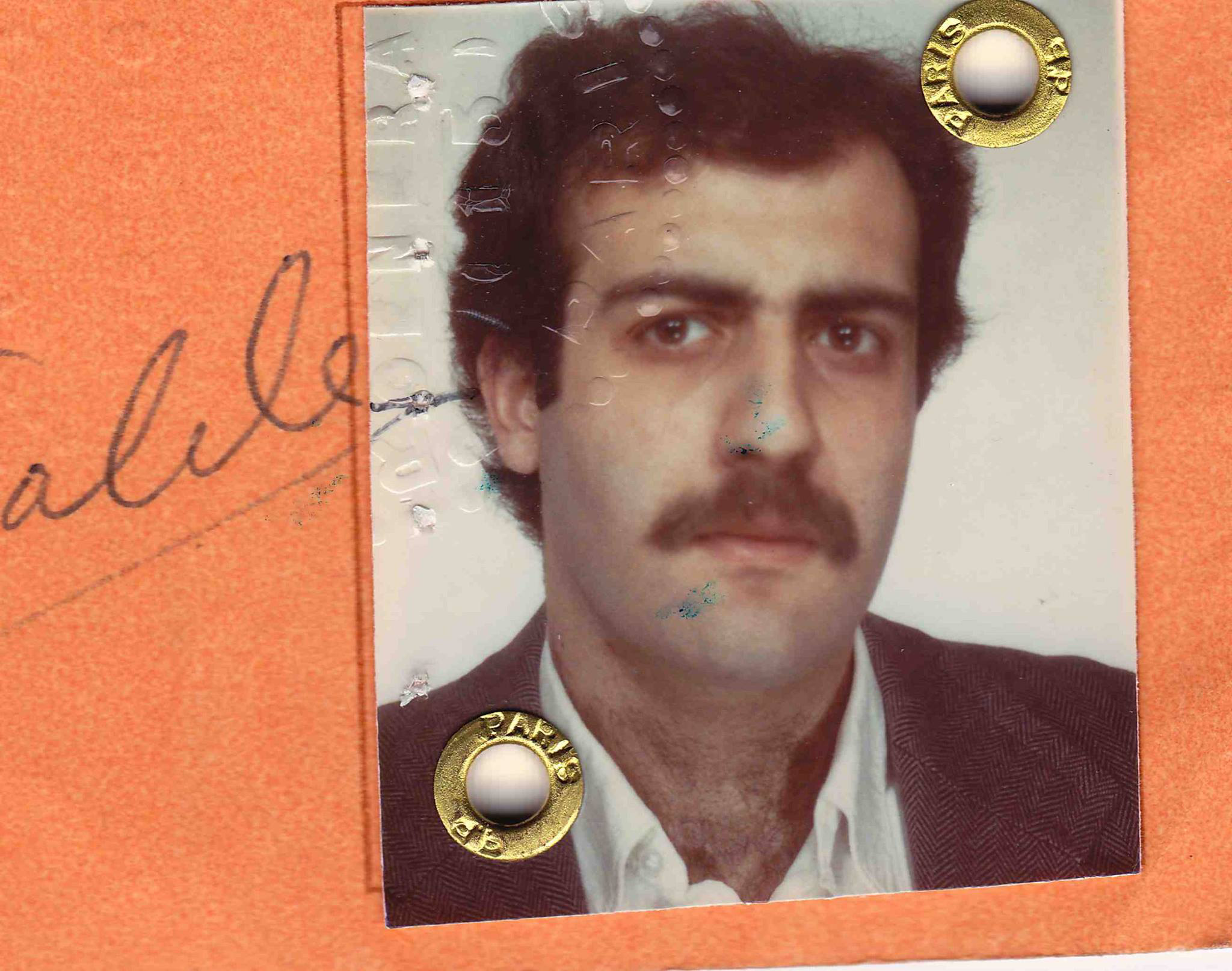

Taleb was born in Amioun, Lebanon. His political Greek Orthodox Levantine family saw its prominence and wealth reduced by the Lebanese Civil War which began in 1975. He is a son of Dr. Najib Taleb, an oncologist and researcher in anthropology, and his wife Minerva Ghosn. Both sides of his family were politically prominent in the Lebanese Greek Orthodox community. On his mother’s side, his grandfather Fouad Nicolas Ghosn and his great-grandfather Nicolas Ghosn were both deputy prime ministers of Lebanon. His paternal grandfather was a supreme court judge; his great-great-great-great grandfather Ibrahim Taleb was a governor of the Ottoman semi-autonomous Mount Lebanon Governorate in 1861. The Taleb family Palazo, built in 1860 by Florentine architects for his great-great-great-great grandfather, still stands in Amioun.

Taleb received his bachelor and master in science degrees from the University of Paris[15] and holds an MBA from the Wharton School at the University of Pennsylvania, and a PhD in Management Science (thesis on the mathematics of derivatives pricing) from the University of Paris (Dauphine)[16] under the direction of Hélyette Geman.[17]

A polyglot, Taleb has a literary fluency in English, French, and classical Arabic, a conversational fluency in Italian and Spanish, and can read classical texts in Greek, Latin, Aramaic, and ancient Hebrew, as well as the Canaanite script.[18][19]

[edit] Finance career

Taleb wrote in Fooled by Randomness that he considers himself less a businessman than an epistemologist of randomness and used trading to attain his independence and freedom from authority.[20] As a trader, he was a pioneer of tail risk hedging (now called “Black Swan Protection”)[21] and has held the following positions: managing director and proprietary trader at UBS; worldwide chief proprietary arbitrage derivatives trader for currencies, commodities and non-dollar fixed income at CS First Boston; chief currency derivatives trader for Banque Indosuez; managing director and worldwide head of financial option arbitrage at CIBC Wood Gundy; derivatives arbitrage trader at Bankers Trust, proprietary trader at BNP Paribas, as well as independent option market maker on the Chicago Mercantile Exchange; and founder of Empirica Capital after which Taleb retired from trading and became a full-time author and scholar in 2004.[22] Taleb is currently Principal/Senior Scientific Adviser at Universa Investments in Santa Monica, California, a tail protection firm owned and managed by former Empirica partner Mark Spitznagel.